Last Updated on April 21, 2024

Navigating the Road Ahead

The interplay between interest rates and consumer behavior is fundamental to economic theory and practical reality. Interest rates, set by central banks like the Federal Reserve in the United States, serve as a lever to control the pace of a country’s economic growth. When interest rates rise, the cost of borrowing increases, which tends to slow down spending and cool off an overheating economy. Conversely, lower interest rates make borrowing cheaper, potentially stimulating investment and spending.

Background on Interest Rates and Consumer Behavior

Interest rates directly influence consumer behavior by affecting borrowing costs. Higher interest rates can deter spending for often financed items — such as homes, cars, and, in some cases, high-value consumer goods like tires. Consumers tend to prioritize necessities and may defer or forgo purchases that are seen as non-essential or that can be postponed.

Various economic theories support the correlation between interest rates and consumer behavior. The Keynesian economic theory, for instance, suggests that as borrowing costs rise, aggregate demand tends to fall, leading to a decrease in overall consumption. This decline in consumption directly affects retailers and manufacturers, who may adjust production, pricing, and employment levels accordingly.

When looking specifically at tire shoppers, the purchase of tires is often associated with maintenance rather than discretionary spending. However, even within this category, higher interest rates can lead to changes in behavior as consumers seek to manage their finances in a more restrictive economic environment.

Objectives and Scope of the Study

The primary objective of this study is to understand how rising interest rates have affected the behavior of tire shoppers. This includes examining shifts in spending patterns, brand loyalty, and the overall purchase decision-making process. The scope of the study encompasses a review of historical interest rate trends, current market analysis, and projections for the future.

Specific objectives include:

Assessing the sensitivity of tire purchases to changes in interest rates.

- Analyzing changes in consumer priorities when selecting tires, such as price versus quality.

- Evaluating the impact on different market segments, including budget, mid-range, and premium tire consumers.

- The study focuses on a specific timeframe in which significant changes in interest rates have occurred. It looks at diverse geographical regions to understand if there are differences based on economic environments.

Methodology

The methodology employed in this study involves a multi-faceted approach:

- Data Collection: Compilation of reliable sources, including economic reports from central banks, industry sales data, consumer credit reports, and consumer spending surveys.

- Qualitative Research: Conducting interviews with industry experts, including tire manufacturers, retailers, and economists, to gain insights into market trends and consumer reactions.

- Quantitative Research: Utilizing statistical tools to analyze the data and identify patterns or correlations between interest rates and tire purchase behavior.

- Case Studies: Review historical interest rate fluctuations to assess the impacts on the tire industry and how consumers and businesses have adapted.

- Surveys: Design and distribute consumer surveys to gather primary data on recent purchasing behavior related to tire shopping.

This methodology ensures a comprehensive understanding of the subject, supported by empirical evidence and expert analysis. It aims to provide a solid foundation for the conclusions drawn and recommendations made after the study.

Economic Fundamentals

Understanding the role of interest rates within the broader context of economic fundamentals is crucial for grasping how they influence the behavior of tire shoppers, the overarching consumer market, and the economy.

The Role of Interest Rates in the Economy

Interest rates are often likened to the “price” of money. They are a critical tool used by central banks to guide economic policy. By influencing interest rates, a central bank can control the money supply, manage inflation, stabilize the currency, and steer the country toward financial goals.

Here’s how interest rates primarily function within the economy:

- Control Inflation: High interest rates help reduce consumer spending and borrowing, slowing inflation down. Conversely, lower rates can stimulate spending and potentially increase inflation.

- Impact on Investment: Higher rates can make borrowing more expensive for businesses, which may slow down expansion and investment. Lower rates can encourage investment by making it cheaper to borrow.

- Government Borrowing: The cost of government borrowing is directly impacted by interest rates, affecting fiscal policy and public sector investment.

- Exchange Rates: Interest rate differentials between countries can influence exchange rates. Higher rates may attract foreign investors seeking better returns, potentially increasing the value of the domestic currency.

Historical Perspective of Interest Rate Fluctuations

Historically, interest rates have fluctuated widely, influenced by various factors, including monetary policy, inflationary pressures, economic booms, and recessions. For instance, stagflation in the 1970s saw high inflation with stagnant demand, leading to high interest rates. In contrast, the Great Recession of 2008 prompted central banks worldwide to slash rates to historic lows to stimulate economic activity.

Periods of low-interest rates have typically been associated with higher consumer spending and borrowing, as seen in the housing boom pre-2008. On the flip side, high interest rates often result in tightened consumer budgets and reduced spending on non-essential goods and services, such as during the early 1980s when the Federal Reserve raised rates to combat inflation.

Current Interest Rate Trends

As of the latest data leading up to 2023, the world has witnessed historically low-interest rates, which began in response to the financial crisis of 2008. However, the tide has started to turn as central banks, particularly the Federal Reserve, have increased rates in response to post-pandemic economic recovery and inflation concerns.

For instance, the Federal Reserve has signaled a series of rate hikes in the United States to curb the highest inflation rates in decades. Similar measures have been seen across other major economies. This increase in interest rates reflects a shift in policy focus from stimulating economic growth to controlling inflation, which has yet to be a central concern for central banks in the previous decade.

Current trends indicate a gradual tightening of monetary policy, which has already begun to affect consumer spending habits, credit availability, and consumer confidence. As these trends continue to develop, they will undoubtedly play a significant role in shaping consumer behavior, including the purchasing patterns of tire shoppers.

This changing interest rate landscape underpins the need for consumers and businesses alike to adapt to a new economic reality, where careful financial planning and strategic decision-making become even more crucial.

For tire shoppers, the increasing cost of borrowing may influence not just when they decide to make their purchases but also how they approach the decision-making process, with a greater emphasis on value, necessity, and financial prudence.

Implications of Fluctuating Inflation Rates on Economic Decision-Making

The graph displays two measures of inflation over time: PCE (Personal Consumption Expenditures) Inflation and Core PCE Inflation, with the latter excluding food and energy prices due to their volatility.

- A red horizontal line indicates the Federal Reserve’s inflation target, typically around 2%.

- The graph’s timeline spans from around 2010 to 2022, showing the trends and changes in inflation over these years.

- Both measures of inflation have fluctuated over time, with periods where they have fallen below or risen above the Federal Reserve’s target.

- In recent months, according to the text in the graph, inflation has substantially exceeded the Federal Reserve’s target, indicating a sharp rise.

- The graph is complemented by three iconographic representations that provide insights into the effects of different inflation levels:

- If inflation is too low:

-

- This is represented by a downward blue arrow, indicating that lower inflation can lead to people deferring spending in anticipation of falling prices, which can weaken the economy.

- If inflation is too high or volatile:

-

- They are shown as a red upward arrow; it is suggested that high or unpredictable inflation makes it difficult for individuals to plan spending and for businesses to set stable prices.

- Moderate inflation:

- They are illustrated by a blue upward arrow that’s less steep than the red, indicating that a moderate level of inflation can assist people in making informed decisions about saving, borrowing, and investing.

The overall message is that while both deflation and high inflation can negatively affect the economy, moderate inflation is beneficial and a key target for monetary policy.

The Tire Market Overview

The tire industry is a significant component of the automotive sector, essential to the production and maintenance of vehicles. The market reflects a complex interplay between consumer demand, technological advances, economic factors, and global supply chains.

Size and Structure of the Tire Market

The global tire market is vast and growing. According to market research, it was valued at over USD 200 billion in the early 2020s. It is expected to grow steadily, driven by increasing vehicle ownership in developing countries and the consistent need for tire replacement in mature markets. The industry is structured around various segments, including passenger cars, trucks, heavy equipment, motorcycles, and aircraft.

The market is divided between the original equipment manufacturer (OEM) and replacement markets. OEM tires are those supplied directly to vehicle manufacturers for new vehicles, while the replacement market consists of tires sold for maintenance and after the original tires’ life cycle.

The tire market is also characterized by its seasonality, with winter and all-season tires experiencing peak demand in respective seasons, particularly in regions with significant weather variations. Additionally, the rise of green tires, designed to be more fuel-efficient and environmentally friendly, reflects a growing segment as the industry moves toward sustainability.

Key Players and Market Share

Several global players with a substantial market share dominate the tire industry. Brands like Bridgestone, Michelin, Goodyear, Continental, and Pirelli are among the top names recognized for their extensive product offerings, innovation, and global reach. These companies maintain their competitive edge through constant R&D, strategic mergers and acquisitions, and scaling up production to meet global demand.

China has emerged as a significant player, with manufacturers like Hangzhou Zhongce and Shanghai Huayi gaining international market share. Their competitive pricing and increasing quality standards have allowed them to compete internationally, particularly in the mid-range market segment.

These key players not only compete on a global scale but also strive to maintain strong distribution networks and relationships with dealerships and service providers to ensure the wide accessibility of their products to the end consumers.

Price Sensitivity in the Tire Industry

Price sensitivity in the tire industry varies by market segment. The replacement tire market, in particular, is highly price-sensitive. Consumers are more likely to compare prices, especially for standard passenger vehicles, where the perceived differentiation between brands is less pronounced. Price promotions and discounts often influence consumer behavior in this segment.

However, there are segments where consumers show less price sensitivity, such as performance and specialty tires, where safety, brand reputation, and specific tire attributes can outweigh cost considerations. The OEM market is also less price-sensitive due to long-term contracts and the integration of tire specifications into vehicle designs.

Economic factors, such as raw material costs and import tariffs, significantly influence tire prices. Fluctuations in the cost of rubber, for instance, directly impact production costs. Geopolitical events and trade policies can also alter prices, with tariffs potentially making certain brands more or less competitive in key markets.

In summary, the tire market is a robust industry characterized by its size and growth potential, dominated by established global players, and influenced by economic factors that drive price sensitivity. It is an industry at a crossroads, facing both challenges and opportunities presented by economic shifts, technological innovation, and evolving consumer preferences.

Impact of Rising Interest Rates

Rising interest rates can affect the economy profoundly, influencing everything from big-ticket investments to everyday purchases. The tire industry, which straddles essential and discretionary spending, is not immune to these macroeconomic shifts.

Direct Effects on the Tire Industry

The tire industry, much like the automotive sector it serves, is sensitive to changes in interest rates for several reasons:

- Capital Investment: Higher interest rates can dampen investment in new manufacturing facilities or the upgrading of existing plants due to the increased cost of borrowing. This can slow the pace at which new technologies and efficiencies are adopted.

- Inventory Financing: Tire retailers often rely on credit to purchase inventory. As borrowing costs rise, the expense of maintaining a large list can increase, leading to higher prices for consumers or reduced stock levels.

- Commercial Clients: For the tire industry, a significant portion of business comes from retail clients, such as trucking companies. These entities may delay the purchase of new tires for their fleets in response to the increased cost of capital, affecting bulk orders.

- Raw Material Costs: Interest rate hikes can also impact the cost of raw materials, such as rubber and oil-based products, which are essential inputs in tire production. The cost increase can be passed on to consumers, affecting demand.

Consumer Spending Power and Disposable Income

Interest rates directly affect consumers’ spending power in several ways:

- Discretionary Spending: As interest rates rise, any debt with variable rates becomes more expensive to service. This can quickly eat into the disposable income for non-essential purchases, including replacing tires that might still have some life left.

- Big-Ticket Item Postponement: The purchase of new vehicles often slows in high-interest rate environments. This, in turn, can reduce the demand for OEM tires. Replacement tire purchases might also be postponed or downgraded to less expensive options.

- Sentiment and Expectations: Beyond the direct financial impact, higher interest rates can influence consumer sentiment, leading to more conservative spending behaviors out of concern for future economic conditions.

Credit Cost and Financing Options for Consumers

Credit cost is central to consumer purchasing decisions, particularly for those who finance their tire purchases through credit cards or specific financing plans.

- Financing Plans: Many tire retailers offer financing plans to make tire purchases more affordable by spreading the cost over time. Rising interest rates can make these plans less attractive as the total cost of the purchase increases.

- Credit Card Purchases: Credit card interest rates are closely tied to central bank rates. As this rises, so does the cost of carrying a balance, which can deter consumers from using credit cards for tire purchases.

- Loan Availability: Banks may tighten their lending standards in higher interest rate environments, making it more difficult for some consumers to obtain credit.

In conclusion, rising interest rates ripple through the tire industry, from manufacturing and inventory costs to consumer spending power and credit availability. These effects can cause market dynamics shifts, prompting businesses and consumers to adjust their behaviors. While some aspects of tire purchasing are relatively inelastic due to safety and legal requirements, the timing, extent, and quality of purchases are subject to the pressures of an interest rate-influenced economy.

Changes in Consumer Behavior

As in many sectors, consumer behavior in the tire industry is not static. It evolves in response to various stimuli, including economic shifts, technological advancements, and market trends. Understanding these changes is crucial for manufacturers, retailers, and marketers alike.

Shifts in Buying Patterns

Recent years have witnessed notable shifts in how consumers approach buying tires:

- Delayed Purchases: In economically uncertain times or when disposable income is squeezed, consumers may delay tire purchases, stretching the lifespan of their current tires beyond the manufacturer’s recommended usage period.

- Preference for Value: There’s a trend towards favoring mid-range products that promise the best value for money — robust performance at a reasonable price — over premium brands or budget options.

- Bundled Services: Buyers are increasingly attracted to packages that include installation, alignment, and future discounts on maintenance, influencing where they decide to purchase.

Price Versus Quality Considerations

The tire purchase decision is often a tug-of-war between price and quality:

- Quality Consciousness: While price is a significant factor, there is growing awareness about the long-term value of investing in quality tires. Better tires can offer improved safety, longer wear, and fuel efficiency, translating to cost savings over time.

- Economic Impact: In a high-interest rate environment, immediate cash flow concerns may push consumers towards less expensive tires, even if they offer a lower total value proposition.

- Brand Loyalty: Consumers with brand loyalty may still opt for higher-priced tires from brands they trust despite economic pressures that could encourage a shift to lower-cost alternatives.

The Move to Online Shopping

The digitization of the retail space has significantly affected consumer behavior:

- Increased Online Purchases: There’s a growing trend of consumers buying tires online. E-commerce platforms offer competitive pricing and provide various choices, customer reviews, and detailed product information.

- Comparison Shopping: Online shopping facilitates easy comparison of prices and features, empowering consumers to make informed decisions without the pressure of in-store sales tactics.

- Direct-to-Consumer Models: Some tire brands have embraced direct-to-consumer sales models, bypassing traditional retail outlets to offer better prices and personalized customer service.

- Mobile Shopping: The convenience of mobile shopping apps has also contributed to the rise of online tire purchases. Consumers can now buy tires from their smartphones, often with the added convenience of arranging installation at a local service center.

The behavioral shifts in tire shopping reflect a broader trend of consumers becoming more informed, value-conscious, and open to leveraging technology to fulfill their purchasing needs. As economic factors like interest rates fluctuate, these trends may become more pronounced, with consumers seeking strategies to make their money go further without compromising safety and quality. The tire industry, recognizing these shifts, continues to adapt, offering a blend of online and offline services to meet its customers’ changing preferences.

Tire Shopper Responses

Tire shoppers’ behavior reflects broader economic conditions, industry trends, and individual financial situations. Rising interest rates and economic uncertainty, in particular, have led to discernible shifts in how consumers approach tire purchases.

Delaying Purchases and Seeking Alternatives

Faced with economic pressures, many tire shoppers are delaying their purchases. This decision can be attributed to several factors:

- Extended Usage: Consumers are more frequently pushing the limits of their tires’ tread life, postponing the purchase of new tires until necessary.

- Alternative Solutions: There is an increased interest in temporary fixes and repair services that can extend the life of existing tires, such as patching or plugging, as more cost-effective short-term solutions.

- Used Tires: The market for used tires has expanded as consumers seek ways to cut costs without compromising safety. Although there are safety considerations with used tires, they are a viable short-term option for many.

Brand Loyalty Versus Cost Savings

The tug-of-war between brand loyalty and the pursuit of cost savings is more intense than ever:

- Eroding Brand Loyalty: While a segment of consumers remains loyal to established tire brands because of perceived quality and safety, increasing financial pressures lead others to consider less expensive alternatives.

- Promotional Offers: Shoppers are more responsive to sales, discounts, and promotional offers from lesser-known brands, seeing them as opportunities to save money.

- Quality Research: Consumers are also more diligent in researching tire quality and longevity, using online reviews and consumer reports to justify choosing a more economical brand over a premium one.

The Rise of Second-Hand and Retreaded Tire Market

In response to a more cost-conscious consumer base, the market for second-hand and retreaded tires has gained traction:

- Second-Hand Market: Second-hand tires, often sold by specialized tire shops or online marketplaces, have become famous for consumers looking to reduce expenses without compromising immediate tire needs.

- Retreaded Tires: Once primarily seen in commercial trucking, retreaded tires are gaining popularity among cost-conscious consumers. These tires, made by applying new tread to worn tires, offer a middle ground between new and used tires in terms of price and performance.

- Environmental Concerns: Besides cost savings, the second-hand and retreaded tire markets are also driven by environmental concerns. As consumers become more eco-conscious, the appeal of reusing and recycling tires grows, aligning with sustainability goals.

In conclusion, the responses of tire shoppers to rising interest rates and economic pressures are varied and dynamic. Many are finding ways to delay purchases and seek cost-effective alternatives, balancing brand loyalty with the need to economize. Simultaneously, the rise of the second-hand and retreaded tire market is a testament to consumers’ changing priorities and adaptability in the face of financial challenges. These market responses are reshaping the tire industry, compelling manufacturers and retailers to reassess their strategies and offerings to meet the evolving demands of their customer base.

Retailer and Manufacturer Strategies

In the face of rising interest rates and the consequent changes in consumer behavior, tire retailers and manufacturers are compelled to adapt their strategies to maintain sales volumes and market share. Pricing tactics, marketing campaigns, and financing options are all being recalibrated to address the challenges of a high-interest rate environment.

Pricing Strategies in a High-Interest Rate Environment

Retailers and manufacturers are implementing several pricing strategies to attract cost-conscious consumers:

- Dynamic Pricing: Many are turning to dynamic pricing models that allow for flexibility in pricing based on demand, inventory levels, and competitive pressures.

- Discounts and Rebates: Offering direct discounts, rebates, and loyalty program benefits can make purchases more appealing in the short term and help maintain customer loyalty.

- Value Offerings: There’s a growing emphasis on value-tier products that offer reasonable quality at a lower price point, expanding the product range to appeal to more price-sensitive consumers.

- Cost Absorption and Efficiency: Manufacturers may absorb some costs or find ways to enhance production efficiency to avoid passing on price increases to consumers.

Marketing and Promotions

With the proper marketing and promotional strategies, tire retailers and manufacturers can better navigate economic downturns:

- Educational Marketing: Providing customers with information about the long-term benefits and safety implications of new tires can justify the investment even in tight economic times.

- Targeted Promotions: Retailers use data analytics to offer targeted promotions that are most likely to convert, such as discounts on tire services or complimentary maintenance.

- Partnership and Sponsorships: Aligning with automotive service providers or events can increase brand visibility and attract customers through associated marketing.

- Digital Marketing: Utilizing online platforms for marketing allows for a more direct and cost-effective way to reach potential buyers, especially the growing segment purchasing tires online.

Financing and Credit Options

Offering consumers various financing and credit options can make tire purchases more feasible despite the financial strain of higher interest rates:

- In-House Financing Plans: Some retailers offer financing plans with competitive interest rates or deferred interest promotions, encouraging consumers to purchase without immediate financial burden.

- Credit Partnerships: Collaborations with credit card companies or financial institutions can provide customers with alternative financing solutions, often with the incentive of an initial period of lower interest.

- Leasing Options: Although less common in the tire industry, some innovative retailers might explore tire leasing options, where consumers pay a monthly fee for tire usage and related services.

- Loyalty Programs: Enhancing loyalty programs to offer financing benefits, such as extended payment terms or special financing rates, can maintain sales and bolster repeat business.

Retailers and manufacturers within the tire industry are actively seeking and deploying strategies to combat the negative impacts of rising interest rates. By implementing flexible pricing, innovative marketing, and diverse financing options, they aim to remain competitive and accessible to consumers facing financial pressures. These strategies are responses to current economic conditions and proactive measures anticipating the evolving expectations and needs of the market.

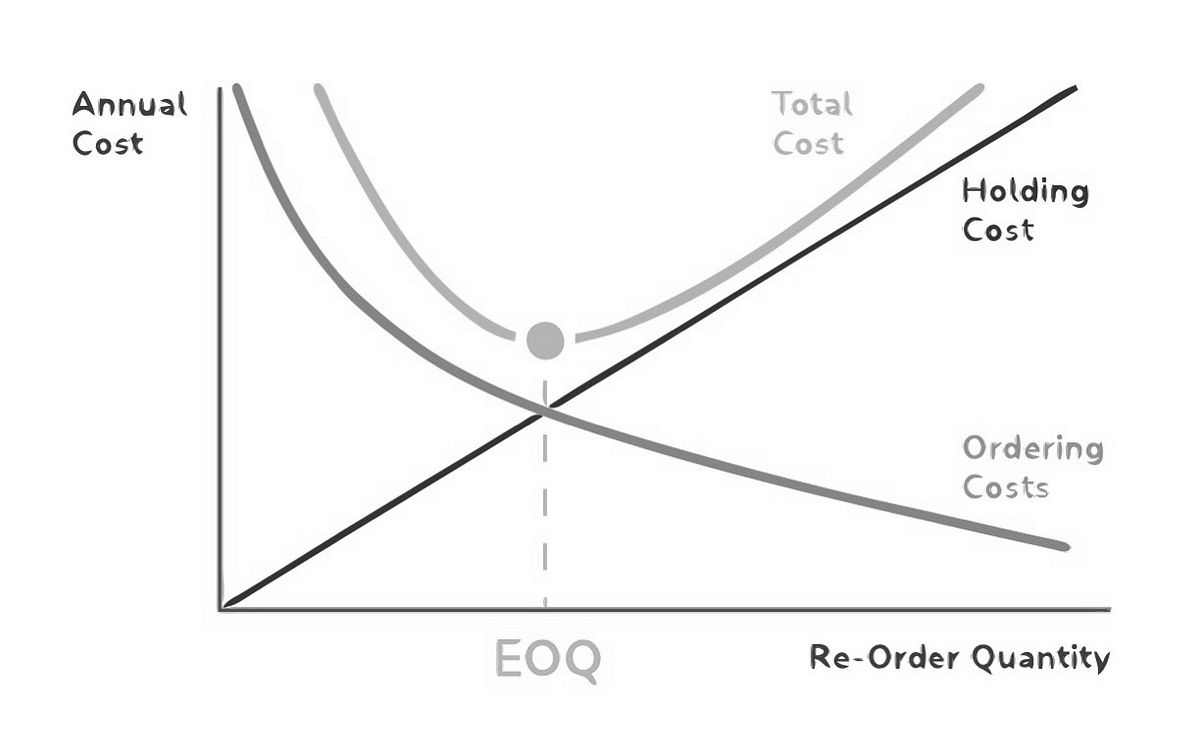

The Impact of Interest Rates on Tire Retail Strategies and Consumer Choices

The graph illustrates the concept of Economic Order Quantity (EOQ), a critical inventory management principle that helps businesses minimize the total inventory cost, including holding and ordering costs. As interest rates rise, inventory maintenance costs increase due to higher capital costs. This can lead businesses, such as tire retailers, to adjust their EOQ to order more frequently in smaller quantities to reduce the capital in stock and avoid the higher expense of holding large amounts of inventory.

In the context of tire shopper behavior, this adjustment in inventory management could lead to a shift in pricing strategies, availability, and possibly the range of options offered by retailers. With a higher cost to finance inventory due to increased interest rates, tire shops may pass on some of these costs to consumers or offer more frequent promotions to turn the list over quickly. As a result, shoppers might experience a change in the price and variety of tires available, which can influence their purchasing decisions towards more cost-effective or available options.

Case Studies

Examining specific instances of how the tire industry has responded to economic fluctuations, particularly interest rate hikes, can provide valuable insights into consumer behavior and the efficacy of retail strategies. Below, we delve into some case studies that reflect the patterns and adaptations in the tire market.

Consumer Behavior During Past Interest Rate Hikes

Historical data offers insights into consumer behavior during periods of rising interest rates. For instance:

- The Early 2000s: The Federal Reserve raised rates steadily from 2004 to 2006. During this time, the tire industry saw a notable shift towards more economical brands and a rise in the sales of used tires, as documented by industry analysts and consumer surveys.

- The 1980s Interest Rate Spike: The early ’80s saw a dramatic rise in interest rates to combat inflation. Market research from that era showed an uptick in maintenance services as consumers sought to extend the life of their tires rather than replace them.

Innovative Retail Strategies in Response to Economic Changes

Retailers have been known to adopt innovative strategies to keep consumers buying despite economic downturns. A few examples include:

- Extended Service Offers: Some retailers have bundled tires with lifetime service packages, including free rotations and balancing, to offer added value.

- Flexible Payment Solutions: In response to the 2008 financial crisis, several tire retailers introduced or expanded their credit offerings, giving consumers more flexibility to manage cash flow in tough times.

- Online and Mobile Sales Platforms: E-commerce has led tire retailers to develop more sophisticated online sales strategies. Companies like Tire Rack have excelled by offering a wide selection, competitive pricing, and detailed consumer guidance online.

Long-Term Effects on Tire Purchasing Trends

The long-term effects of economic changes on tire purchasing patterns can be profound:

- The Shift to All-Season Tires: Economic downturns have contributed to the rising popularity of all-season tires as consumers look for products that offer year-round performance and eliminate the need for seasonal tire changes.

- Increase in Retread Tire Acceptance: The economic recession of 2008 saw a noticeable increase in consumers’ acceptance of retreaded tires, which has continued influencing purchasing decisions.

- Eco-Friendly and Fuel-Efficient Tires: With the emphasis on cost-saving extending to fuel consumption, the market has seen a steady increase in demand for tires that offer improved fuel efficiency.

These case studies illustrate the complex interplay between economic forces and consumer behavior in the tire industry. They highlight the immediate reactions to interest rate hikes and the longer-term trends that can reshape the industry. Retailers and manufacturers that closely monitor these trends and adapt accordingly are better positioned to weather economic storms and emerge with solid customer loyalty and brand recognition.

Discussion

This section will discuss the impact of rising interest rates on the tire market, drawing on recent consumer surveys, expert opinions, and economic forecasts to explore the implications for the industry’s future.

Analysis of Recent Consumer Surveys

Recent consumer surveys offer a real-time pulse on how buyers are reacting to the changing economic landscape:

- Shifting Priorities: Surveys indicate consumers increasingly prioritize essential and long-term investments over discretionary spending as interest rates rise. This shift often results in delayed tire purchases or opting for less expensive brands.

- Perception of Quality and Safety: Despite economic constraints, a significant segment of consumers will not compromise on the quality and safety of tires, a sentiment that surveys reflect even during financial downturns.

- Online Shopping Habits: The convenience and potential cost savings of online shopping for tires have been underscored in surveys, with many consumers indicating a preference for digital platforms that offer price comparisons and direct delivery options.

Expert Opinions and Economic Forecasts

Economic forecasts and expert opinions provide insight into the anticipated movements of the market and consumer behavior:

- Interest Rates and Inflation: Economists suggest that while higher interest rates aim to curb inflation, the delay in the impact can cause short-term contractions in discretionary spending, affecting tire sales.

- Recovery Trajectories: Analysts often have differing opinions on recovery, with some forecasting a quick rebound in consumer spending post-interest rate hikes, while others expect a more prolonged period of conservative purchasing behavior.

- Technological Advancements: Industry experts predict that continued advancements in tire technology and materials will create new market segments and drive future sales, regardless of economic fluctuations.

Economic Data and Analysis Methods

The appendices provide supplementary material that supports the main content of the report, detailing the economic data used and the methods applied to analyze the impact of rising interest rates on the behavior of tire shoppers.

Economic Data Used:

- Interest Rate Trends: Data from central banks and financial institutions provides insights into the historical and current trends in interest rates.

- Consumer Spending Patterns: Information from economic surveys and retail reports that track consumer spending habits about tire purchases.

- Industry Financial Reports: Publicly available financial statements from leading tire manufacturers and retailers offer a window into the market’s health and response to economic changes.

Analysis Methods:

- Comparative Analysis: This involved comparing current market data with historical trends to identify patterns and correlations between interest rates and tire purchasing behaviors.

- Statistical Modeling: Statistical tools and models were employed to quantify the impact of interest rates on consumer behavior and to forecast future market trends.

- Expert Consultation: Insights gathered from industry experts were synthesized with quantitative data to provide a comprehensive picture of the market dynamics.

Implications for the Future of the Tire Market

The confluence of economic conditions and evolving consumer preferences will likely shape the future of the tire market:

- Resilience of the Market: The tire market’s strength is likely to be tested in times of economic downturn, but it’s expected to remain robust due to the essential nature of the product.

- Sustainability Trends: There is a growing expectation that sustainability practices will become increasingly important to consumers, potentially influencing purchasing decisions as much as price and performance.

- Adaptation to Digital Shifts: The market will continue to adapt to the digital shift, with e-commerce and online services expected to take up a larger share of sales, influenced by consumer preference and the need for cost-efficiency.

In conclusion, the analysis of consumer surveys, expert opinions, and economic forecasts suggests that while the tire market faces immediate challenges due to rising interest rates, there are also opportunities for growth and adaptation. The industry will likely see continued innovation, a greater focus on sustainability, and a shift toward digital consumer engagement. How well tire manufacturers and retailers can navigate these changes and align with consumer expectations will determine their success in the future.

Conclusion & Recommendations

Summary of Findings

The exploration of the tire market in the context of rising interest rates has yielded some illuminating findings:

- Consumer Behavior: Increasing interest rates shift consumer behavior towards more cost-conscious decisions. This includes delaying tire purchases, seeking cheaper alternatives, or opting for retreaded tires.

- Market Adaptation: Retailers and manufacturers have adapted to these economic pressures through various strategies, including diversified financing options, price promotions, and a focus on online sales platforms.

- Economic Impact: The direct and indirect effects of interest rates on the tire industry are significant, influencing everything from raw material costs to consumer spending power.

Recommendations for Retailers and Consumers

For Retailers:

- Enhance Online Presence: Strengthen e-commerce capabilities to capture the growing segment of consumers who prefer to research and purchase tires online.

- Offer Financing Options: Provide flexible payment plans or partner with financial services to offer credit options, helping customers manage more considerable expenses over time.

- Focus on Value: Emphasize the long-term value of high-quality tires to consumers, highlighting safety and cost-effectiveness over time.

For Consumers:

- Consider Total Cost of Ownership: Look beyond the purchase price to evaluate the total value provided by tires, including longevity, fuel efficiency, and safety.

- Stay Informed: Research and compare tire options online to find the best deals and promotions.

- Plan Ahead: Anticipate future needs and take advantage of promotional periods to purchase tires before an urgent necessity arises.

Future Research Directions

To further understand the dynamics of the tire market, future research should focus on:

- Longitudinal Studies: Track consumer behavior over extended periods to assess the long-term effects of economic changes.

- Technology Impact: Examine how advancements in tire technology may alter consumer preferences and market demand.

- Global Market Trends: Analyze the impact of international economic policies on the worldwide supply chain and tire market.

Transition to Call to Action

In light of these findings and recommendations, Tires Easy offers a seamless and efficient online buying experience for those looking to make an informed tire purchase. With a vast selection of brands and tire types suited to every need, and budget and comprehensive information to help guide your decision, Tires Easy stands out as a consumer-friendly platform during these economically fluctuating times.

Whether planning or needing new tires, our platform provides a convenient, transparent, and affordable way to ensure your vehicle is equipped with the right tires for any journey. You can confidently purchase your tire with user-friendly search tools, detailed product descriptions, and customer reviews.

Take your time. Ensure your safety and optimize your vehicle’s performance today. Click the button below to find the perfect tires for your car at Tires Easy.

Shop Tires Now

FAQs

Why are tires so much more expensive?

Tires have become more expensive due to various factors, including increases in raw material costs, advanced technology, and features for safety and efficiency, as well as rising manufacturing and transportation expenses.

What causes tire pressure to rise?

Tire pressure can rise due to temperature increases as air expands when warmed. For every 10 degrees Fahrenheit change in air temperature, tire pressure can change about 1 PSI.

What does research show consumers care most about when selecting a tire dealer?

Research shows that consumers prioritize competitive pricing, quality, variety of tire selections, trustworthy service, and convenience when selecting a tire dealer.

What benefits from rising interest rates?

Rising interest rates can benefit savers and investors who receive higher returns on interest-bearing assets and indicate a strengthening economy.

What are the effects of interest rates?

Interest rates can influence borrowing costs, consumer spending, inflation, and economic growth. Higher rates typically reduce borrowing and spending, while lower rates may stimulate them.

Are interest rates going up?

As of my last update, many central banks worldwide have raised interest rates to combat inflation and stabilize economic conditions.

How do consumers adjust to price changes?

Consumers typically adjust to price changes by seeking more affordable alternatives, reducing the quantity of purchases, or postponing non-essential buys. They may also shift their loyalty to brands or stores that offer better value or discounts.

How does inflation affect shoppers?

Inflation erodes the purchasing power of consumers, making goods and services more expensive. Shoppers may prioritize essential items and look for deals, discounts, or substitute products to manage their budgets more effectively.

How does a recession affect consumer buying behavior?

During a recession, consumers often become more cautious with spending, prioritizing necessities over luxuries. They may increase savings, reduce debt, and look for lower-priced goods to stretch their budgets.